The State of Kansas currently has 136 active leads in its business recruitment pipeline, of which 59% are manufacturing related. A trend among these projects is rapid technological development in transportation manufacturing, resulting in new processes that require large investments in new facilities and equipment. Aerospace manufacturing, sustainable aviation fuel and sustainable vehicles are key drivers of these new opportunities.

The AIM-K bill (HB 2308) will create a tool to show that Kansas is open for business, helping Wichita remain the Air Capital of the World and leveraging Wichita State University’s status as the #1 aerospace research and development program in the nation. The bill slightly enhances the state’s traditional incentives, giving Kansas a competitive edge to successfully recruit these manufacturers, while maintaining strict eligibility requirements, including meaningful clawbacks, and only awarding benefits AFTER companies create jobs and make investments.

Eligible industries (also referred to as Qualifying Activities) include:

Kansas Sales Tax Exemption

Training

Capital Investment Tax Credit (refundable)

Payroll Tax

Kansas First

Clawback Provisions

This program automatically sunsets on December 31, 2027.

| CATEGORY | AIM-K | APEX | TRADITIONAL |

|---|---|---|---|

| Capital Investment Tax Credit | Up to 10% investment tax credit (refundable) unless located in a non-MSA area of the state, then it’s fixed at 10% | Up to 15% investment tax credit (refundable) | HPIP: 10% income tax credit up to 50% may be transferable; credit that exceeds the transferee’s tax liability may be carried forward (not refundable) |

| Payroll Tax | 100% of payroll withholding tax rebate for up to 10 years | Up to 10% of total payroll costs for 10 years | PEAK: 95% of the payroll withholding tax for up to 7 years; high-impact projects that create at least 100 new jobs may be eligible for up to 10 years |

| Training | Up to $5M reimbursement for no-cost access to any Kansas community college or technical college of employer’s choice (approximately 1,860 workers) | Reimbursement up to $5M at a 50% rate for 5 years for training | KIT/KIR: $1,200 – $2,000 per trainee; KIR requires a dollar-to-dollar match; KIT does not require a match |

| Kansas First | Up to $1M for $20M of procurement of goods made in a fiscal year from one or more Kansas companies not associated with the qualified company | N/A | N/A |

| Kansas Sales Tax | 100% construction material tax exemption | 100% construction material tax exemption | 100% construction material tax exemption |

Example Firm: Wichita Aerospace Manufacturing Company

This ROI analysis utilizes an example firm, to be located in Wichita, Sedgwick County, which meets all the project requirements and qualifies for all the benefits of the AIM-K bill. The firm would be a large-scale advanced aerospace manufacturing operation capable of producing several aerospace products.

ROI Description and Results

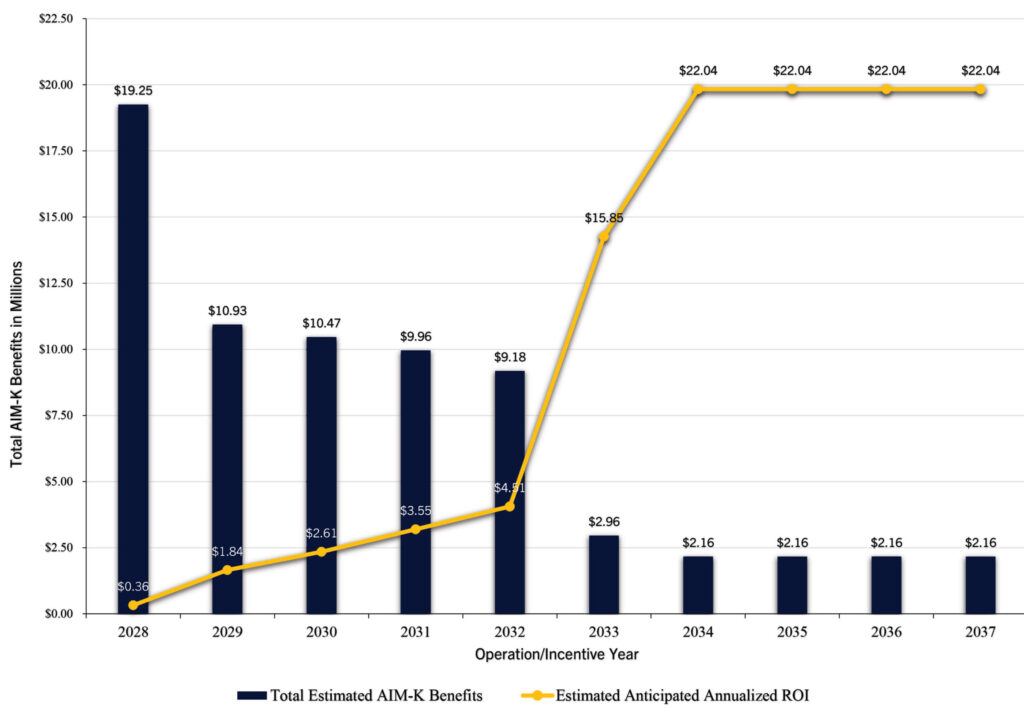

This study measures the total economic impact from the example firm, which includes: Jobs created, value-added and economic output. The economic impact is then measured against the anticipated AIM-K benefits provided by the state for ten years of the operations phase of the project. We expect yearly variation in the AIM-K benefits, because they can be claimed at different stages of the project. The graph below tracks the increase in ROI, as the dollar amount of AIM-K incentives decreases.

The results indicate:

The project will yield a positive ROI in year 1 of the operation phase, which means the state will start recovering the incentives, and that ROI will be greater than $1 by the second year of operation. The ROI for every dollar the state will spend during the ten years of the operation phase ranges from $0.36 to $22.04.

When comparing the estimated total impact with the anticipated AIM-K incentives over the ten-year period, the overall anticipated annualized ROI is $21.38. Which means, for every dollar spent by the state, the Kansas economy will gain $21.38.